The Current State and Future of CFM56 USM Engine Pricing

Dovydas Meipariani, Senior Sales Manager at Magnetic Group

The CFM56 USM market had a slow start in 2022. However, as the year progressed, there was a substantial pick-up, especially in the parts market. When analyzing our 48 months of data, with insights gathered based on demand and pricing, these two signals indicate a considerable increase in certain parts.

Since the prorated value of LLPs (life-limited parts) with an increase of CLP (catalog list price) stayed stable, the value of most demanded airfoils in HPC (high-pressure compressor), HPT (high-pressure turbine) and LPT (low-pressure turbine) sections grew substantially.

Growing prices of parts increased significantly throughout 2022 compared to the yearly growth of prices during pre-Covid times. The factors that had the most considerable impact were analyzed — concluding with predictions of what the industry can expect in the upcoming 1-2 years for each engine type.

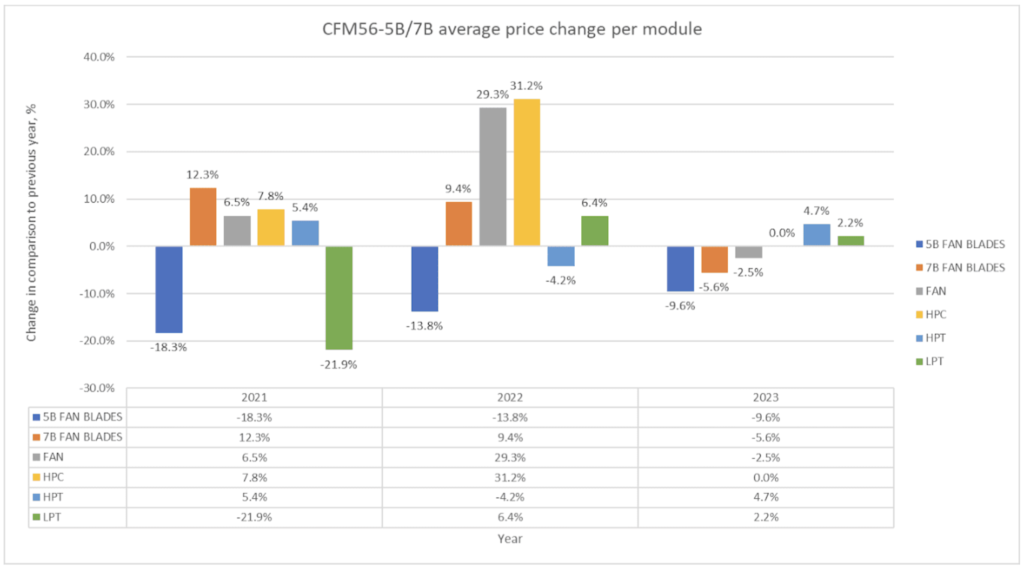

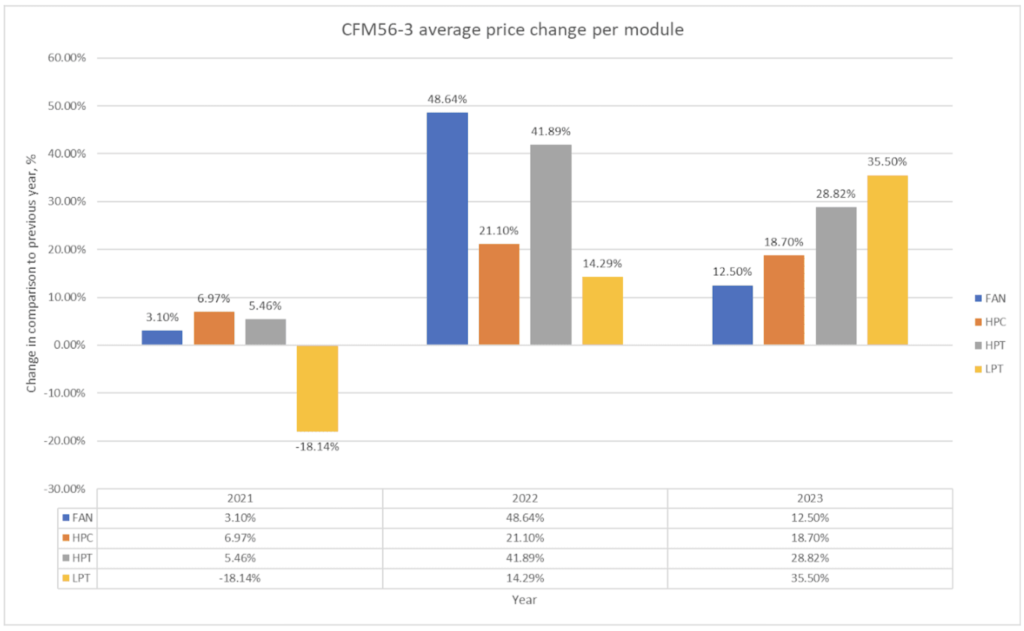

For data analysis, we picked the most requested part numbers and compared the average price change per part to the previous year. Due to the large number of part numbers analyzed (≈ 150), the parts were assigned to corresponding engine modules and reflect a percentage of the change in comparison with the previous year per module.

Fluctuation in CFM56-5B/-7B Pricing

Looking closer at CFM56's most demanded USM (used serviceable material) data, unlike in most scenarios, average prices for 5B fan blades did not increase to pre-Covid levels. On the contrary – the average price per blade experienced a reduction of 13.9% each year, with 2021 showing the most prominent difference.

In 2019, the introduction of SB 72-1080 hiked up the prices even more. In some cases, the pair part number of the blades had a lower CLP than a single overhauled blade in the market. A primary reason for the price change was reduced flight traffic during 2020 due to COVID-19. It increased blade availability in the market, and businesses trying to get a return on investment and an inflow of cash.

Another dominant reason for the recent price change is the continuation of the saturated market. Comparing the availability of 5B fan blades throughout these years, it became much easier to purchase them, making the competition sharper, hence the slight price drop.

Consequently, it is expected that the price of the fan blades for the -5B engine will moderately rise due to Airbus A321 P2F (passenger to freight) conversion, and TATs (turnaround time) in repair shops, which are higher because of staff shortages and large USM quantities received.

Whilst the price for 7B fan blades grew in the past 2 years, during the start of this year prices lowered slightly, so we expect prices of 7B fan blades to further increase due to not many 7B engines available for teardowns, meaning supply shortages and increased prices.

Prices Increasing in Fan Module Market

The overall outlook of fan module USM, excluding fan blades, shows a significant increase in average pricing during 2022, with OGVs making the most substantial impact due to a rise in CLP. Historically CLP increase on average is 5-8% each year; however, for OGVs, it increased almost 30% each year, reflecting current market pricing.

Unlike -5B/-7B fan blades, -3 fan blades returned to a pre-Covid price level due to repair price growth and scarcity of older tags in the market. The recent prices will likely stay stable with occasional drops, at least until the end of the year. Then, it will slowly start decreasing due to more businesses shifting their focus towards 5B and 7Bs, and exiting the -3 market altogether.

But let's delve deeper into the engines, particularly the high-pressure compressor (HPC) USM. For analysis, the most demanded stages of 6 to 9 blades (excluding locking ones), vanes and HPC stator cases were selected. Unlike fan blade prices for 5B/7B, pricing for HPC USM increased on average by 13%. –3 blades grew similarly at 15.6%. The most considerable growth was during 2022, by 31.2% and 21.1%, respectively.

Several impactful factors instigated such a notable increase. First, due to the continued staff shortage, CFM could not deliver new LEAP engines for the 737 Max and A320 family Neos. This meant all operators who expected new 737 Max and A320Neo to replace their NGs and A320 family had to squeeze more cycles out of 5Bs and 7Bs, resulting in more top case/bottom case repairs and higher demand for HPC blades.

Going back to -3 HPC blades, most of those can also be used for -5B in some cases, making up for the shortages of blades. Yet any pre-SB engine needing top/bottom case repair will require the same part numbers, making blades removed from -3 a viable choice. A significant repair pricing increase is another reason for the -3 HPC blade pricing growth. The growth of prices is expected to continue and reach a more stable point by the end of the year after the CFMI announced ramping up delivery of new LEAPS to waiting operators.

2023 HPT Prices Passing 2021 Prices

Moving on to the engine's hot section, the high-pressure turbine (HPT), the analysis covers pricing changes of different part numbers of HPT blades, NGVs and shrouds. Interestingly, the data shows a drop in average prices for 5B/7B HPT airfoils, but only in 2022 by 4.2% compared to 2021. The prices have, however, grown throughout the year and by the start of 2023, we already see averages going up to 4.7%, passing the initial price of 2021.

Also, more significant growth numbers for CFM56-3 are seen. The prices for HPT USM grew by 48.64% on average in 2022, with HPT blades making the most notable impact on overall numbers for the -3 HPT section. Based on the gathered data from our engine shop and customers, the analysis shows that throughout 2020-2023 CFM56-3 still occupied quite a few shop slots for major and minor repairs. The most demanded USM are scarce in the market with few teardowns happening in 2020-2021, while increasing scrap rates/repair pricing/TATs drove the prices of the -3 HPT section up.

Predictably, the growth of -3 HPT USM is yet to stabilize by the end of 2023, with quite a few teardowns happening in 2022 and more occuring at the beginning of 2023. As for CFM56-5B/7B, the trend of prices is slowly going up and will likely continue to grow in the upcoming years, especially for HPT blades. The leading cause is them reaching a half and end life of cycles.

An Up & Down Low Pressure Turbines Market

Lastly, when examining LPT (low-pressure turbine) USM, the most demanded part numbers of LPT blades and NGVs of various stages were discovered. Compared to the HPT module, the picture is a little different, where prices dropped significantly in 2020-2021 by 21.9% for -5B/-7B and 18.14% for -3.

However, the market picked up slightly during 2022, with -3 LPT material average prices growing higher than -5B/7B by 14.29%. Prices reached new heights between the end of 2022 and the start of 2023, with an increase of 35.5% compared to 2022. Even though hot section material CLPs have grown by almost 10% on average each year, it did not affect LPT USM the same way it affects most LLP prices due to PRV (prorated value).

As for the -5B/7B LPT material price, the growth is picking up slowly. According to our data, many vendors offer material, so supply usually meets demand. Still, -3 LPT USM is scarcer in comparison, especially for the most demanded part numbers, making it a seller’s market. Hence a significant increase in pricing can be observed by the end of 2022 and the first months of 2023.

Both stage 1 LPT blades and NGVs had the most impactful numbers. Steady growth is anticipated for -5B/7B LPT module USM due to more green-time rebuilds taking place. However, we do not expect prices to return to 2018-2019 levels since the -5B/7B USM market is becoming affordable to more businesses. For -3, the expectation is similar to the HPT module USM, with a slight increase in the top dollar for LPT NGVs and blades.

A Promise of Recovery in 2023

In the past three years, we have seen the biggest USM market plunge in the last decade, followed by a recovery for specific engines and modules. Among the driving factors are the COVID-19 impact on flight traffic, the inability to use new aircraft (Boeing 737 Max grounding) and the delayed delivery of new engines (CFM LEAP) due to staff shortages caused by the pandemic.

Expectedly, the pandemic was the main contributor to the market dip in 2020-2021, creating a ripple effect which has also affected price recovery/increase for specific materials. Our data suggests that the demand in the 5B/7B USM market will stay approximately the same into this year as -5B/7B is about to reach its maturity – the most profitable phase.

As for -3, it is heading towards the end of its cycle, making a -3 USM a niche market with many businesses turning their attention to 5B/7B USM. As a result, the -3 USM market will start slowly declining in 2023 and reaching its lowest points heading into 2026.